Yield Restriction In Focus

Cities all around this country are attracting more residents than ever before. It’s not an unprecedented shift for all, but some cities are experiencing their time in the limelight for the first time. The prospects for continued growth is there, but how will the infrastructure keep up? That’s where the tax-exempt debt market comes in.

New money construction bonds are being issued every day. Projects to build new city halls, expand entertainment districts, improve underground sewer networks, and more. Borrowing against expected future revenues to seize the opportunities of today. It’s new, it’s exciting, and the possibilities are endless. And sometimes, so is the timeline for completing these projects. That’s why there is no time like the present for us to bring project yield restriction back into focus.

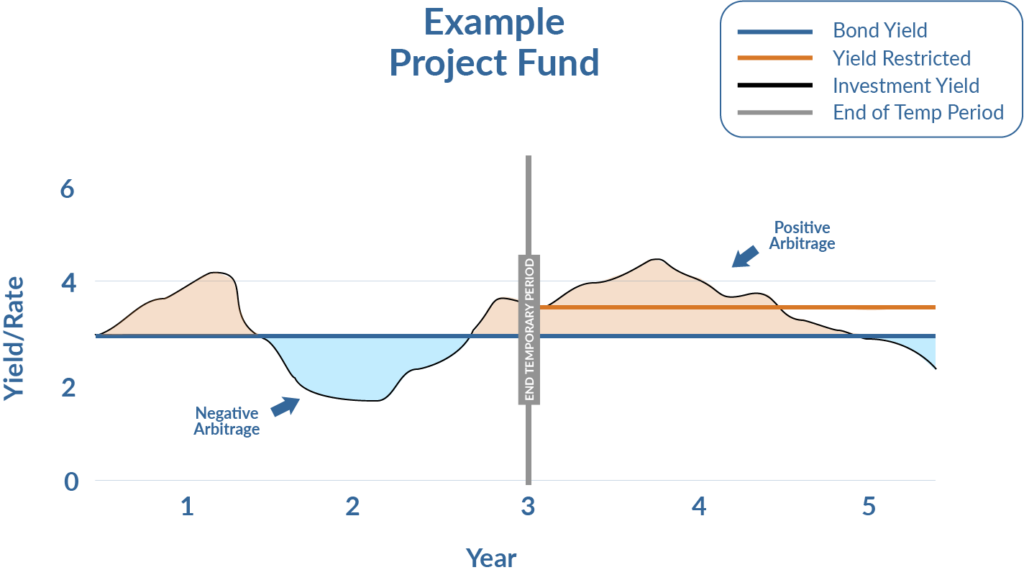

The IRS expects tax-exempt projects to be completed within three years of the issuance date. For this temporary period, project proceeds received from a tax-exempt bond issue can be invested at an unrestricted yield. Once that temporary period expires however, your remaining project proceeds are subject to yield restriction.

So, take a moment to review your outstanding tax-exempt projects. Is your project taking a lot longer than expected? Are you experiencing delay after delay? Has your project hits the skids? You may owe a yield reduction payment to the IRS.

These yield restriction rules can impact the tax-exempt status of certain municipal bonds. If you hold bonds issued in 2019 or 2020, it’s important to understand how they might apply to you.

Positive Rebate & Yield Restriction Liabilities

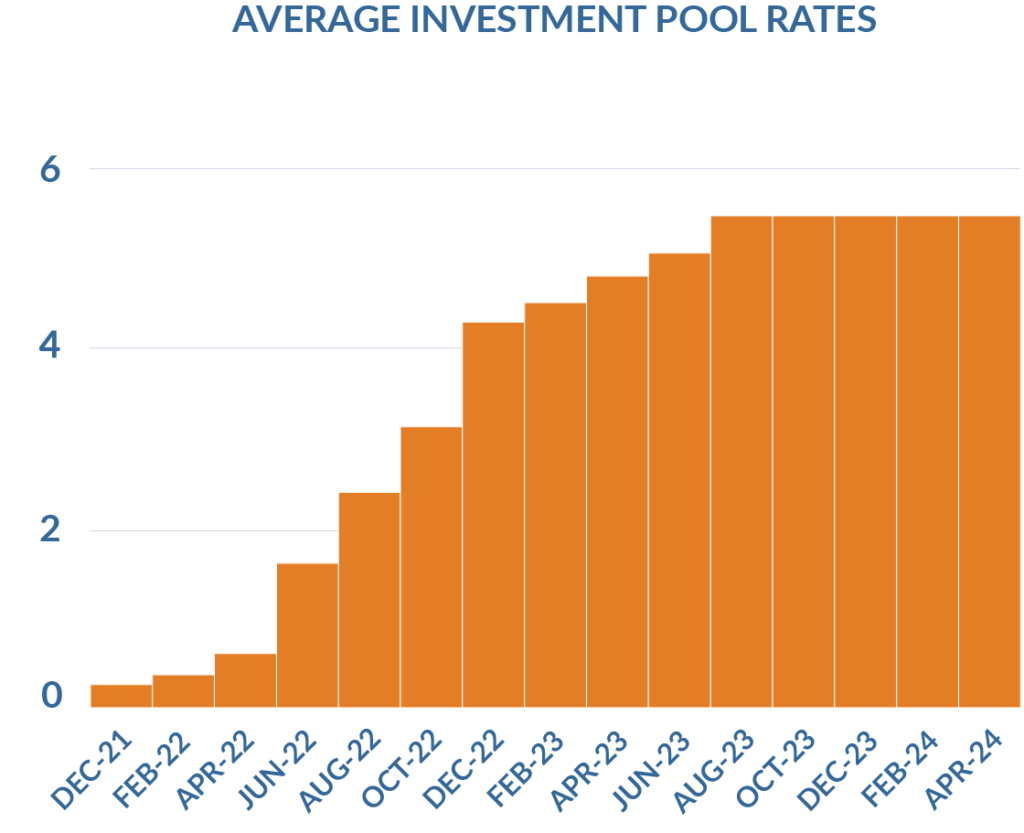

Since 2009, the bond industry has had historically low borrowing rates of .50% to 3% resulting in inexpensive financing cost for new builds and the opportunity to refund older bonds at significantly lower borrowing rates. At the same time, yields on investments of bond proceeds were also low,minimizing the chance of earning arbitrage rebate or yield restriction liabilities.

Beginning in 2022, investment earning yields have increased to unprecedented levels, exceeding 5% and continuing to rise. The combination of low borrowing rates and higher investment yields has resulted in bond issues accruing both arbitrage rebate liabilities and yield restriction liabilities.

With rising interest rates, excess cash balances could yield investment returns higher than your bond yield and leave you with unreported liabilities.

Why We Recommend More Frequent Calculations

- A calculation resulting in a positive liability requires payment to the IRS within 60 days of the filing date. A short time considering the number of records required to be collected and analyzed.

- Spending exceptions exempt the issuer from arbitrage rebate, but these exceptions can be tough to meet without frequent guidance from your arbitrage professional.

- No more digging through stacks of old records every five years! Annual calculations only require your staff to provide a year’s worth of investment records.

- Encumber arbitrage rebate or yield restricted liabilities in your books and reserve the necessary funds long before your payment is due.

Our Recommendations Are As Follows

1. The Issuer should review their Bond Compliance Policy Manual.

a. Our firm has a Policy Manual designed for tax-exempt bond compliance, if needed.

2. Consider completing arbitrage rebate reports annually, instead of the 5th year “filing” date.

3. Discuss with staff the importance of delivering investment data requests timely.

4. As future bonds are issued, notify our firm immediately so that we may analyze any refundings and adjustments of gross proceeds.

5. Notify our firm prior to completing a cash defeasance of bonds.

6. Review, at least once a year, the current arbitrage positions for each bond issue and identify future arbitrage report due dates.

7. Spend project proceeds prior to the end of the 3-year temporary period.

a. Bonds issued in 2019 and 2020 that have not spent their project funds by the end the 3rd anniversary date after issuance will likely have accrued a yield restriction liability that will be due in 2024 or 2025.

Don’t navigate this alone! Our firm specializes in helping organizations with Yield Restriction issues.

Our calculations are performed by CPAs, reviewed by our in-house tax attorney and have been error free for 30 years. ACS clients benefit from working with an experienced, friendly and accessible staff that takes the legwork out of Arbitrage Calculations, leaving you with one less thing to worry about.

Contact us today to speak with our bond compliance specialists.